Cut Your Mortgage Term: Expert Advice for Canadian Borrowers

2025-05-02 | 07:33:17

Introduction

In Canada, a typical mortgage lasts 25 to 30 years—but that doesn’t mean you have to wait decades to be mortgage-free. With smart payment strategies and a bit of financial discipline, you can shorten your amortization and save tens of thousands in interest.

This guide explores how switching from monthly to weekly, bi-weekly, or accelerated payments—combined with lump-sum contributions—can fast-track your journey to mortgage freedom.

Why Payment Frequency Can Cut Years Off Your Mortgage

The structure of your payment schedule plays a massive role in how quickly you build equity and reduce interest. Adjusting your payment frequency to suit your cash flow can:

-

Lower your total interest payments

-

Accelerate principal reduction

-

Shorten your mortgage term

-

Help you build equity faster

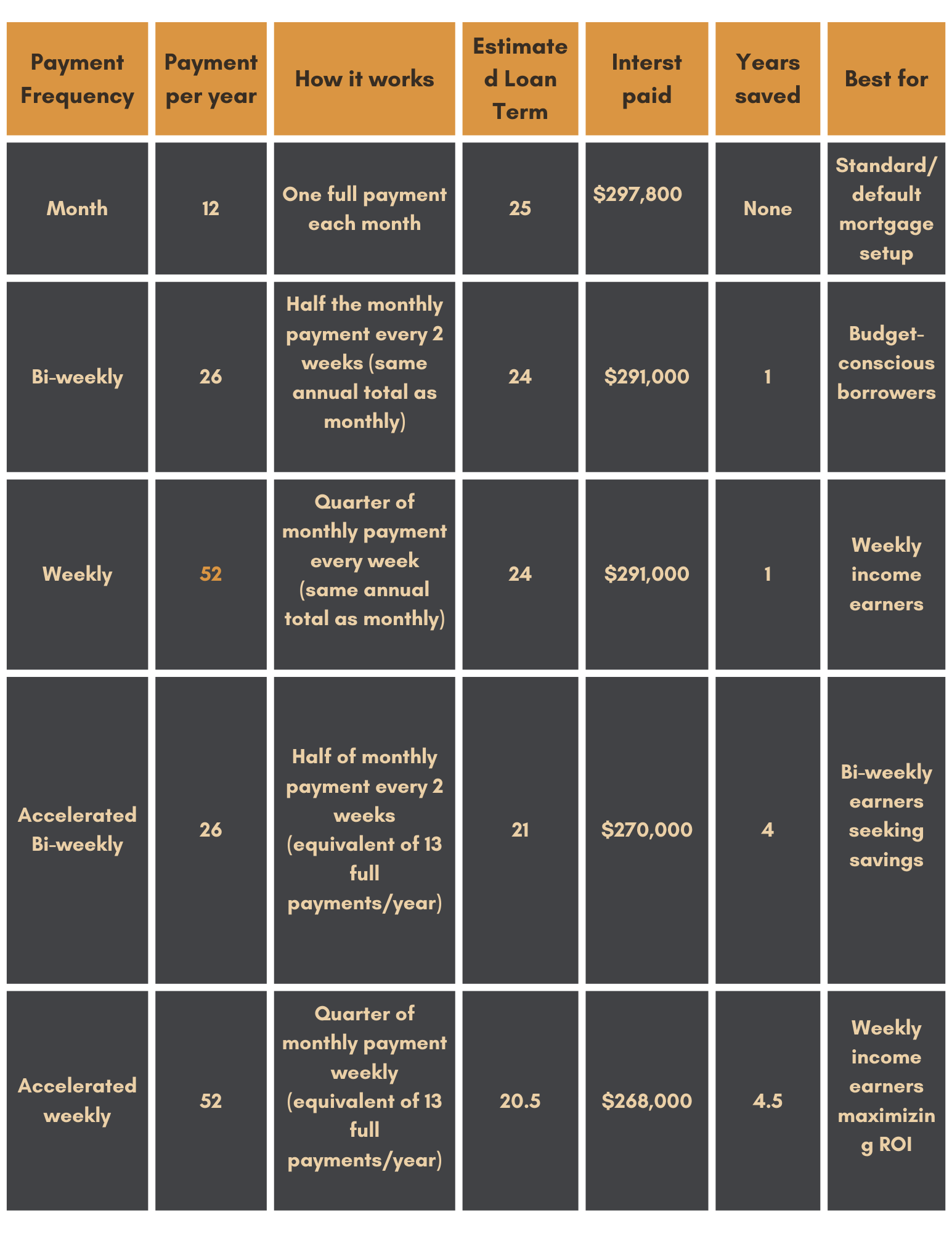

Mortgage Payment Frequency Comparison Table

Here’s a visual comparison of payment options based on a $400,000 mortgage at a 5% interest rate over 25 years:

Note: All figures are approximations for illustrative purposes.

Real-Life Example: Save Thousands in Interest

With a $400,000 mortgage over 25 years at 5%:

-

Monthly: ~$297,800 interest, 25-year term

-

Accelerated Bi-Weekly: ~$270,000 interest, ~21-year term

-

Accelerated Weekly: ~$268,000 interest, ~20.5-year term

Savings: Up to $29,800 and 4.5 years off your mortgage!

Maximize Your Strategy With Lump-Sum Payments

Most Canadian lenders offer prepayment privileges that allow annual lump-sum payments of up to 15% of the original mortgage amount without penalties.

-

Example: For a $250,000 mortgage, that’s up to $37,500/year you can put directly toward your principal.

-

These lump-sum payments reduce your loan balance, which lowers future interest and accelerates payoff.

-

Pro Tip: Always confirm your prepayment options with your lender before proceeding.

Tips to Supercharge Your Mortgage Payoff

1. Align With Your Income Cycle

Choose weekly or bi-weekly payments that match how you're paid—this makes budgeting easier and encourages consistency.

2. Increase Payments as You Earn More

Every time you get a raise or bonus, apply part or all of it to your mortgage. Even small increases compound over time.

3. Use Unexpected Windfalls Wisely

Inheritances, tax refunds, or year-end bonuses can be directed toward lump-sum mortgage payments. These one-time boosts can cut years off your term.

Conclusion

Becoming mortgage-free doesn’t require huge income jumps or drastic changes—just smarter strategies. By switching to accelerated payments and making lump-sum contributions, you can:

-

Shorten your mortgage by 4–5 years

-

Save over $25,000 in interest

-

Achieve financial freedom sooner

Start today. Choose a payment frequency that works for you, and take full advantage of your prepayment privileges.

FAQs

Q: How much faster can I pay off my mortgage with accelerated payments?

A: You can cut up to 4.5 years off a 25-year mortgage using accelerated weekly or bi-weekly payments.

Q: Are there penalties for making lump-sum payments in Canada?

A: Most lenders allow annual lump-sum payments of up to 15% of the original mortgage without penalties. Always verify your lender's terms.

Q: What is the difference between bi-weekly and accelerated bi-weekly payments?

A: Accelerated bi-weekly payments equal 13 full monthly payments per year, while standard bi-weekly totals 12, speeding up mortgage payoff.

Q: Can I switch payment frequencies at any time?

A: Many lenders allow one change per term. Contact your provider for details.

Q: How do weekly payments help me save on interest?

A: They reduce the time interest accrues between payments, lowering the total interest and term length.